Best Invoicing Software

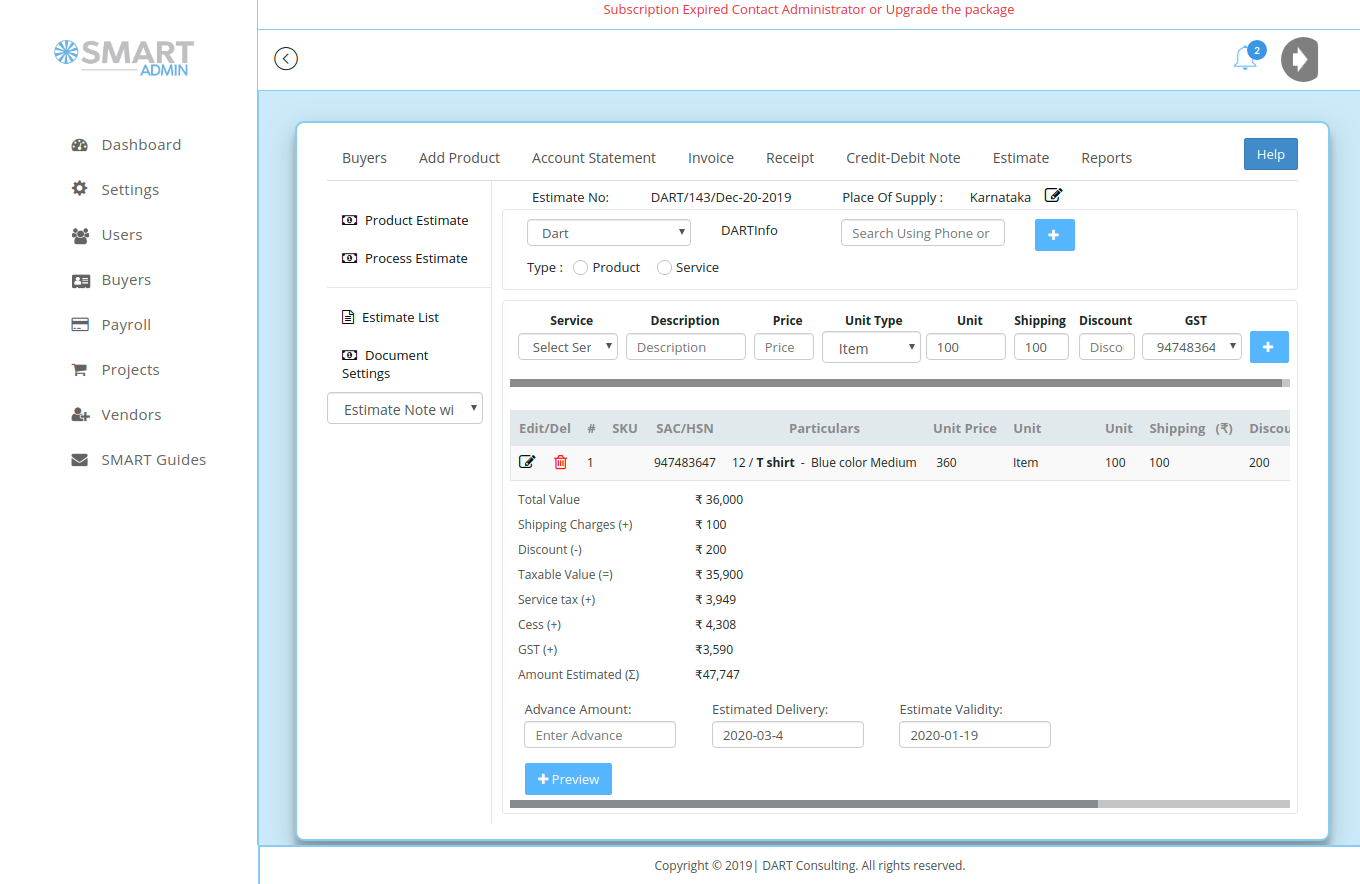

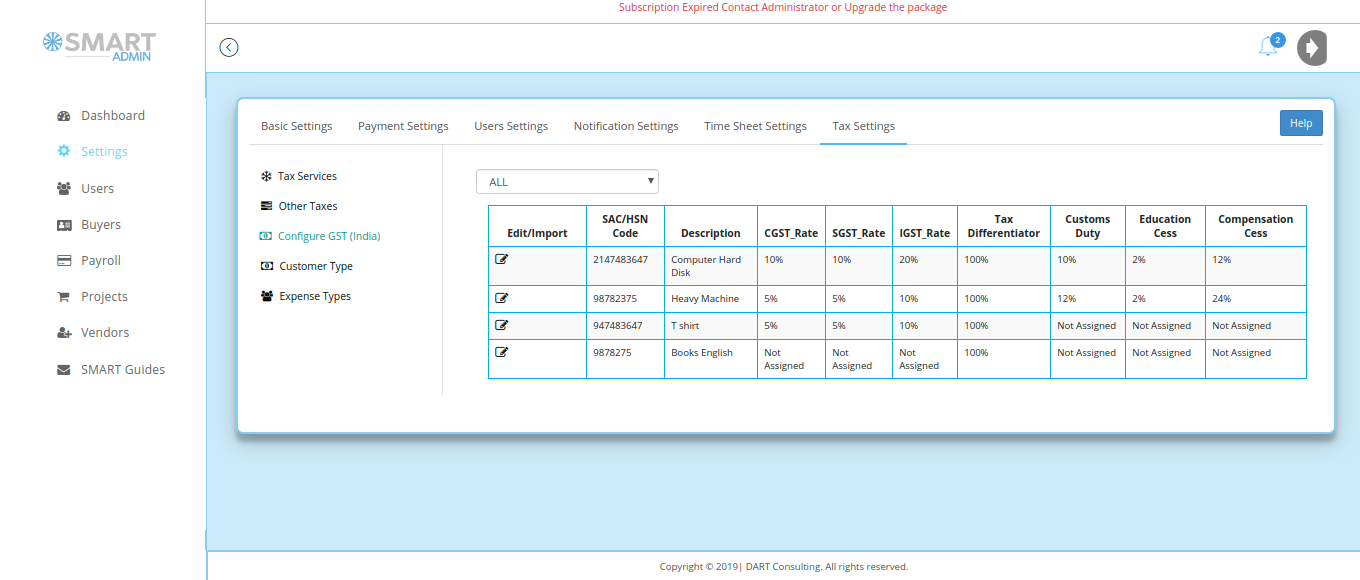

Smart Admin has best invoicing software that links estimate/quote, invoice, receipt, and Credit/Debit to ensure accurate flow of data points in the overall invoicing process. This will ensure zero error in all statutory filings connected with invoicing. The invoice billing software captures data points associated with each of the documents and number it properly. The Import and Export transactions as well as SEZ transactions of both products and services are listed in the process.

Need for using GST Invoice Software

Smart Admin invoice management software has been designed to match up with the requirements of GST filing and minimize errors in transactions. The billing software has been designed taking into account of the level of expertise of common man. The Smart Admin Invoice Software can be operated by anyone who can handle Gmail and WhatsApp.

Further, Smart Admin has been configured to handle the requirements of e-invoicing. The e-invoice generated needs to be validated at Invoice Registration Portal (IRP). This will generate a unique Invoice Reference Number (IRN) and digitally sign the e-invoice and also generate a QR code. The QR Code will contain vital parameters of the e-invoice and return the same to the taxpayer who generated the document in first place. The IRP will also send the signed e-invoice to the recipient of the document on the email provided in the e-invoice. Smart Admin GST invoice software has the option to update the invoice with IRN as generated and send the same to buyers.

The options as given for GST Invoicing Software India are expected to speed up the filing process and minimize errors. With Smart Admin, users can go for multiple GST invoice formats, receipt and cr/dr vouchers according to requirements for generating Tax Invoices under GST.

With Smart Admin, users can go for multiple GST invoice formats, receipt and cr/dr vouchers according to requirements for generating Tax Invoices under GST.

The GST invoicing software is linked with all other transactions to avoid duplication of efforts and missing entries. There are options to send Invoices via email or SMS instantly. If you are looking for best invoicing software India, then we can confirm that Smart Admin is one of the best invoicing software India, a solution for you.